Friedrich Vorwerk Group SE (VH2.F) Stock Price

€100.6 10.5%

to add to portfolio

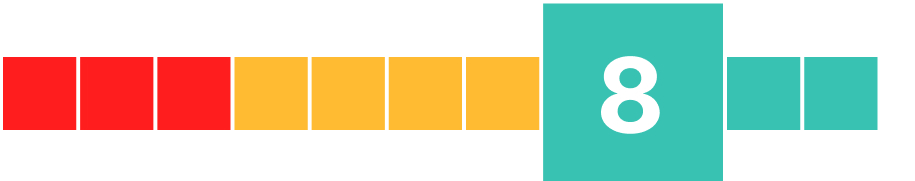

AI Score

-

Alternative

9 -

Fundamental

9 -

Technical

7

Our AI Score rates companies on a scale from 0 to 10, based on alternative data points such as web traffic, app downloads, and job postings — combined with financial health indicators and technical signals. Scores are designed to reflect relative strength or weakness across these factors, helping users compare companies and track changes over time.

Sign up to get access to more historical data and insights on Friedrich Vorwerk Group SE, AI stock picks, stock alerts and much more.

VH2.F AI Stock Analysis

Financial Performance

Friedrich Vorwerk Group SE has shown impressive financial performance in the last quarter. Their revenue of €159.3M represents a significant year over year increase of 107.6%. The gross profit also showed robust growth, with an increase of 1429.8% from the previous year and up by 17.1% from the previous quarter, reaching €85.7M. Operating income profit demonstrated substantial growth as well, up by a remarkable 2205.3% YoY and by 62.6% QoQ to €27.2M.

The EBITDA ratio stands at a healthy level of 0.19 indicating good profitability and efficiency in operations.

Stock Price

The stock price is currently at €79.8, reflecting an upward trend with an increase of 13.2% in the last month and a considerable surge of 203.4% YoY which indicates strong investor confidence in the company's prospects.The PE ratio is relatively high at around 29 indicating that investors are willing to pay more for each unit of net income due to expectations of future earnings growth.

From a technical perspective, the RSI value is currently at moderate levels (43), suggesting neither overbought nor oversold conditions exist.The stock's current price is significantly above its long-term (200-day) moving average (€59), which signals bullish sentiment among investors.

Alternative Data Signals

In terms of alternative data signals,Friedrich Vorwerk Group SE shows positive signs on several fronts.Web traffic has increased substantially MoM suggesting growing interest or engagement with their online presence.Job postings have seen consistent growth YoY indicating potential expansion plans or business growth.There is a very positive business outlook among employees which can be indicative of strong internal morale and confidence in the company's future.

Furthermore, there has been considerable growth in social media followers on both Instagram and Facebook over the last 90 days, indicating growing public interest or brand recognition.

Conclusion

In conclusion, Friedrich Vorwerk Group SE demonstrates strong financial performance with significant revenue and profit growth. The stock price shows an upward trend with positive technical indicators. Alternative data signals such as web traffic, job postings, employee sentiment, and social media following also suggest a positive outlook for the company. Therefore, the analysis is bullish on Friedrich Vorwerk Group SE's stock.

Note: This AI Stock Analysis is based on data as of October 18. Our members can refresh and get access to an up-to-date AI stock analysis.

Sign up

Friedrich Vorwerk Group SE (VH2.F) Price Prediction

Based on a combination of financial analysis, technical indicators, and insights from alternative data, we predict that the stock price of Friedrich Vorwerk Group SE (VH2.F), currently trading at €100.6, will... Sign up to access price prediction.

About VH2.F

-

Friedrich Vorwerk Group SE provides various solutions for transformation and transportation of energy in Germany and Europe.

-

Symbol

VH2.F

-

Market

XETRA

-

Industry

Oil & Gas Midstream

-

Market Cap

2B

Similar Stocks

|

Friedrich Vorwerk Group SE VH2.DE |

€100 17.5% |

8 |

News

No news articles.

VH2.F Alternative Data

Web Traffic

Friedrich Vorwerk Group SE receives an estimated 4485 monthly visitors to friedrich-vorwerk.de.

-

Web Traffic

4485

-

Change from Previous Month

61.6%

-

3 Month Change

14.1%

-

YoY Change

14.1%

Facebook Engagement

Friedrich Vorwerk Group SE has engaged 226 users via their Facebook Page over the last 7 days.

-

Facebook Engagement

226

-

Daily Change

36.9%

-

1 Month Change

175.6%

-

3 Month Change

402.2%

-

YoY Change

402.2%

Instagram Followers

Friedrich Vorwerk Group SE has 2,338 Instagram Followers on its main Instagram account, up by 8.8% over the last month.

-

Instagram Followers

2338

-

Daily Change

0%

-

1 Month Change

8.8%

-

3 Month Change

16.1%

-

YoY Change

16.1%

Youtube Subscribers

Friedrich Vorwerk Group SE has 223 subscribers on its main Youtube channel, up by 0.5% over the last month.

-

Youtube Subscribers

223

-

Daily Change

0.5%

-

1 Month Change

0.5%

-

3 Month Change

3.7%

-

YoY Change

3.7%

Job Postings

Friedrich Vorwerk Group SE currenly has an estimated 237 open job postings, up by 0.4% over the last month.

-

Job Postings

237

-

Daily Change

0%

-

1 Month Change

0.4%

-

3 Month Change

16.2%

-

YoY Change

16.2%

Reddit Mentions

Friedrich Vorwerk Group SE has been mentioned an estimated 0 times in investment subreddits on Reddit over the last 24 hours.

-

Reddit Mentions

0

-

Daily Change

0%

-

1 Month Change

0%

-

3 Month Change

0%

LinkedIn Followers

4,727 are following Friedrich Vorwerk Group SE on LinkedIn, up by 2.9% over the last month.

-

LinkedIn Followers

4727

-

Daily Change

2.9%

-

1 Month Change

2.9%

-

3 Month Change

12.3%

-

YoY Change

12.3%

LinkedIn Employees

According to LinkedIn, Friedrich Vorwerk Group SE has 126 employees, up by 1.6% over the last month.

-

LinkedIn Employees

126

-

Daily Change

1.6%

-

1 Month Change

1.6%

-

3 Month Change

6.8%

-

YoY Change

6.8%

Business Outlook

According to employee reviews, the business outlook among employees at Friedrich Vorwerk Group SE is 100 out of 100 (very bullish).

-

Business Outlook

100

-

Change from Previous Month

0%

-

3 Month Change

0%

-

YoY Change

0%

News Mentions

Friedrich Vorwerk Group SE was mentioned 0 times in the news yesterday.

-

News Mentions

0

-

Daily Change

0%

-

1 Month Change

0%

-

3 Month Change

0%

-

YoY Change

0%

VH2.F Financials

VH2.F Key Metrics

-

Total Revenue

€159.3M

-

Net Income

€13.5M

-

Earnings per Share

€0.68

-

Free cash flow

€126M

-

EBITDA

€29.6M

-

EBITDA Ratio

0.186128

-

Total Assets

€437.6M

VH2.F 2-year Revenue & Income

VH2.F 2-year Free Cash Flow

VH2.F Technicals

VH2.F SMA

VH2.F RSI

FAQ

What's the current price of Friedrich Vorwerk Group SE (VH2.F) Stock?

The price of an Friedrich Vorwerk Group SE (VH2.F) share is €100.6.

What's the market cap of Friedrich Vorwerk Group SE?

The current market cap of Friedrich Vorwerk Group SE is 2B.

What are some stocks similar to Friedrich Vorwerk Group SE (VH2.F) that investors often compare it to?

Friedrich Vorwerk Group SE (VH2.F) is often compared to similar stocks such as Friedrich Vorwerk Group SE.

What is the forecast for Friedrich Vorwerk Group SE's stock price in 2026?

Using a mix of financial analysis, technical indicators, and alternative data, we forecast Friedrich Vorwerk Group SE's stock price to be around €112.6 in 2026. Starting from the current price of €100.6, this represents a 11.9% change in price, indicating a bullish outlook for the stock.

How to buy Friedrich Vorwerk Group SE (VH2.F) Stock?

Friedrich Vorwerk Group SE stock is available for purchase through numerous brokerage firms, including online platforms. Investors can also buy Friedrich Vorwerk Group SE shares via trading apps on their smartphones or by utilizing services like robo-advisors for automated investing.