TrendEdge: Smarter Market Research with AI-Driven Insights

Comprehensive Stock Coverage

TrendEdge provides data and insights on over 6,000 stocks across global exchanges, helping users explore companies in industries ranging from technology and healthcare to emerging markets and niche sectors.

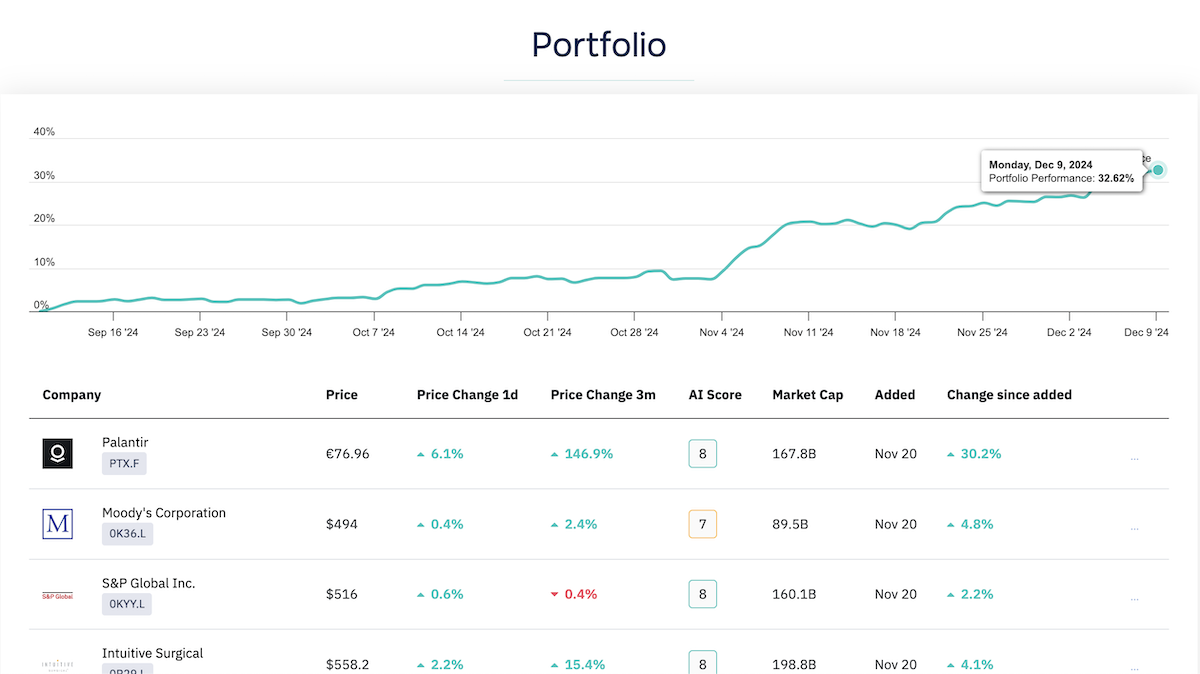

AI-Powered Stock Scoring

Each stock is evaluated with an AI Score (0–10), calculated using thousands of data points — including fundamental metrics, technical indicators, and alternative data like web traffic, app downloads, and social sentiment. These scores highlight noteworthy signals and support deeper market research.

Alternative Data Integration

TrendEdge combines traditional and alternative data streams to offer a broader perspective on market activity. Users can track social media trends, employee sentiment, search traffic, and more — helping to surface potential developments earlier than traditional sources.

Research Tools for Every Strategy

Whether you're analyzing growth stocks, value-oriented companies, dividend payers, or high-volatility sectors like AI and renewable energy, TrendEdge equips you with real-time data to explore a wide range of investment themes.

Custom Signals & Analytics

The platform allows users to customize their experience by filtering signals based on sectors, risk preferences, or trading strategies. From long-term trend analysis to short-term signal alerts, TrendEdge supports a range of research needs.

Cross-Market Coverage

TrendEdge analyzes multiple financial markets including equities, commodities, currencies, and crypto, giving users access to a wide array of data across asset classes.

Who It’s For

- Retail investors looking to expand their research toolkit

- Traders seeking real-time alerts based on AI-generated insights

- Professionals who rely on fast, clean, and data-rich tools

- Beginners aiming to understand market trends without the noise

Education & Transparency

In addition to real-time signals, TrendEdge offers educational resources, market overviews, and customizable dashboards to help users understand the data behind each signal — without speculation or hype.

FAQ Summary

What’s the best stock to buy now?

There’s no single best stock for every investor. TrendEdge helps you explore companies showing strong signals based on AI and alternative data.

What sectors are trending in 2025?

AI, fintech, renewable energy, and biotechnology are currently attracting strong interest due to innovation and market demand.

Does TrendEdge give buy/sell advice?

No. TrendEdge provides data and AI-powered scores to support market research. It does not offer investment advice or make buy/sell recommendations.

How accurate are TrendEdge’s signals?

AI signals are based on real-time analysis of market and alternative data. While they highlight patterns and momentum, no signal guarantees performance.

Can I customize signals?

Yes. Users can tailor TrendEdge alerts based on trading preferences, strategies, and sectors of interest.