Oklo (OKLO) Stock Price

$134.8 0.5%

to add to portfolio

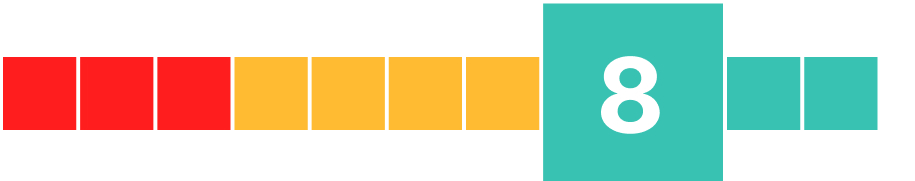

AI Score

-

Alternative

10 -

Fundamental

6 -

Technical

8

Our AI Score rates companies on a scale from 0 to 10, based on alternative data points such as web traffic, app downloads, and job postings — combined with financial health indicators and technical signals. Scores are designed to reflect relative strength or weakness across these factors, helping users compare companies and track changes over time.

Sign up to get access to more historical data and insights on Oklo, AI stock picks, stock alerts and much more.

OKLO AI Stock Analysis

Financial Performance

Oklo has not reported any revenue or gross profit for the last quarter, which is unchanged from the previous quarter. This suggests that Oklo may be in its early stages as a company or it's operating in a sector where it takes time to generate revenue. The company's operating income profit was -$15.4M, which shows a significant decrease both quarterly and annually. This could imply increasing operational costs or investments that have not yet resulted in profits.

The EBITDA ratio being at 0 indicates that Oklo has not generated earnings before interest, taxes, depreciation, and amortization. Additionally, the high negative PE ratio of -252.18 and negative EPS of -0.38 suggest that the firm is currently unprofitable.

Stock Price

The stock price has shown an impressive growth rate with an increase of 34.9% over the past month and an astronomical rise of 1421.1% YoY to $95.83 per share currently from well below this level a year ago.

The RSI value stands at 78.2 which typically indicates that the stock is currently overbought and might be due for a correction soon.

Alternative Data Signals

In terms of alternative data signals, there are positive trends across website traffic (up by 7.1% MoM), job postings (up by 23.3% MoM) indicating potential expansion plans, and social media followers on Twitter (up by 79.3%) and Facebook (up by 41.%). These increases suggest growing public interest in Oklo's operations which can contribute positively to its brand image and future business prospects.

Conclusion

While the stock's recent performance has been exceptional, the company's financials show that it is not yet profitable. However, alternative data signals suggest a positive outlook for the company. Therefore, while there may be short-term volatility due to high RSI levels indicating overbought conditions, Oklo's stock could have potential in the long term if it manages to convert its operational activities into profitability.

Note: This AI Stock Analysis is based on data as of September 17. Our members can refresh and get access to an up-to-date AI stock analysis.

Sign up

Oklo (OKLO) Price Prediction

Based on a combination of financial analysis, technical indicators, and insights from alternative data, we predict that the stock price of Oklo (OKLO), currently trading at $134.8, will... Sign up to access price prediction.

About OKLO

-

Oklo Inc.

-

Symbol

OKLO

-

Market

NYSE

-

Industry

Regulated Electric

-

Market Cap

19.9B

Similar Stocks

|

PG&E PCG |

$16.72 3.2% |

5 |

|

NextEra Energy NEE |

$84.04 1% |

6 |

|

Duke Energy DUK |

$125.2 0.3% |

4 |

|

DTE Energy DTE |

$141.6 0.6% |

5 |

|

Entergy ETR |

$96.66 0.7% |

5 |

News

OKLO Alternative Data

Web Traffic

Oklo receives an estimated 176051 monthly visitors to oklo.com.

-

Web Traffic

176051

-

Change from Previous Month

7.1%

-

3 Month Change

40.6%

-

YoY Change

40.6%

Twitter Followers

Oklo has 30,087 Twitter Followers on its main Twitter (also known as X) account, which is up by 7.1% over the last month.

-

Twitter Followers

30087

-

Daily Change

0.5%

-

1 Month Change

7.1%

-

3 Month Change

15.7%

-

YoY Change

15.7%

Facebook Engagement

Oklo has engaged 88 users via their Facebook Page over the last 7 days.

-

Facebook Engagement

88

-

Daily Change

1.1%

-

1 Month Change

57.5%

-

3 Month Change

51.7%

-

YoY Change

51.7%

Youtube Subscribers

Oklo has 1,810 subscribers on its main Youtube channel, up by 7.1% over the last month.

-

Youtube Subscribers

1810

-

Daily Change

0%

-

1 Month Change

7.1%

-

3 Month Change

13.1%

-

YoY Change

13.1%

LinkedIn Followers

40,614 are following Oklo on LinkedIn, up by 7.9% over the last month.

-

LinkedIn Followers

40614

-

Daily Change

0.2%

-

1 Month Change

7.9%

-

3 Month Change

25.7%

-

YoY Change

25.7%

Job Postings

Oklo currenly has an estimated 43 open job postings, up by 38.7% over the last month.

-

Job Postings

43

-

Daily Change

0%

-

1 Month Change

38.7%

-

3 Month Change

87%

-

YoY Change

87%

LinkedIn Employees

According to LinkedIn, Oklo has 215 employees, up by 7.5% over the last month.

-

LinkedIn Employees

215

-

Daily Change

0%

-

1 Month Change

7.5%

-

3 Month Change

21.5%

-

YoY Change

21.5%

Reddit Mentions

Oklo has been mentioned an estimated 43 times in investment subreddits on Reddit over the last 24 hours.

-

Reddit Mentions

43

-

Daily Change

32.8%

-

1 Month Change

290.9%

-

3 Month Change

437.5%

Reddit Sentiment

The sentiment Score for Oklo is 58 out of 100, which represents a neutral sentiment.

-

Reddit Sentiment

58

-

Daily Change

14.5%

-

1 Month Change

26.3%

-

3 Month Change

4.5%

News Mentions

Oklo was mentioned 1 times in the news yesterday.

-

News Mentions

1

-

Daily Change

93.8%

-

1 Month Change

0%

-

3 Month Change

0%

-

YoY Change

0%

OKLO Financials

OKLO Key Metrics

-

Total Revenue

$0

-

Net Income

-$10.3M

-

Earnings per Share

$3.91

-

Free cash flow

-$13.5M

-

EBITDA

-$15.3M

-

EBITDA Ratio

0

-

Total Assets

$281.7M

OKLO 2-year Revenue & Income

OKLO 2-year Free Cash Flow

OKLO Technicals

OKLO SMA

OKLO RSI

FAQ

What's the current price of Oklo (OKLO) Stock?

The price of an Oklo (OKLO) share is $134.8.

What's the market cap of Oklo?

The current market cap of Oklo is 19.9B.

What are some stocks similar to Oklo (OKLO) that investors often compare it to?

Oklo (OKLO) is often compared to similar stocks such as PG&E, NextEra Energy, Duke Energy, DTE Energy and Entergy.

What is the forecast for Oklo's stock price in 2026?

Using a mix of financial analysis, technical indicators, and alternative data, we forecast Oklo's stock price to be around $149.8 in 2026. Starting from the current price of $134.8, this represents a 11.1% change in price, indicating a bullish outlook for the stock.

How to buy Oklo (OKLO) Stock?

Oklo stock is available for purchase through numerous brokerage firms, including online platforms. Investors can also buy Oklo shares via trading apps on their smartphones or by utilizing services like robo-advisors for automated investing.