ProShares UltraPro QQQ (TQQQ) Stock Price

$108.9 3.4%

to add to portfolio

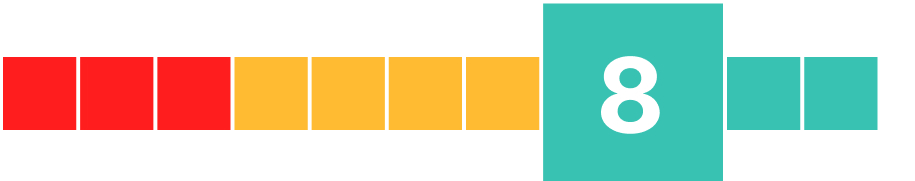

AI Score

-

Alternative

N/A -

Fundamental

N/A -

Technical

8

Our AI Score rates companies on a scale from 0 to 10, based on alternative data points such as web traffic, app downloads, and job postings — combined with financial health indicators and technical signals. Scores are designed to reflect relative strength or weakness across these factors, helping users compare companies and track changes over time.

Sign up to get access to more historical data and insights on ProShares UltraPro QQQ, AI stock picks, stock alerts and much more.

TQQQ AI Stock Analysis

Financial Performance

Given the nature of ProShares UltraPro QQQ as an exchange-traded fund (ETF), traditional financial metrics such as revenue, gross profit, net income and profitability ratios are not applicable. Instead, this ETF's performance is measured by its tracking of the NASDAQ-100 Index.

Stock Price

The stock price of ProShares UltraPro QQQ has shown a positive trend with a significant increase of 45% year over year. The recent month also shows a bullish trend with a rise of 6.1%. The current trading price is $105.31 which is significantly above its 200-day moving average at $77.98, indicating strong upward momentum in the stock price.

The RSI value stands at 71.33, suggesting that the stock could be entering overbought territory and may see some pullback or consolidation in the near term.

Alternative Data Signals

In terms of alternative data signals for ETFs like ProShares UltraPro QQQ, factors such as market sentiment, macroeconomic indicators and investor interest can play a significant role. Given its focus on tech-heavy NASDAQ-100 companies, trends in these sectors can greatly influence the ETF's performance.

Conclusion

Taking into account all these factors together - robust upward movement in the stock price backed by strong performance of NASDAQ-100 index constituents and positive investor sentiment towards tech stocks – our analysis leans towards being bullish on ProShares UltraPro QQQ's stock despite potential short-term volatility indicated by high RSI.

ProShares UltraPro QQQ (TQQQ) Price Prediction

Based on a combination of financial analysis, technical indicators, and insights from alternative data, we predict that the stock price of ProShares UltraPro QQQ (TQQQ), currently trading at $108.9, will... Sign up to access price prediction.

About TQQQ

-

The fund invests in financial instruments that ProShare Advisors believes, in combination, should produce daily returns consistent with the fund's investment objective.

-

Symbol

TQQQ

-

Market

NASDAQ

-

Industry

Asset Management

-

Market Cap

28.5B

Similar Stocks

|

Invesco QQQ QQQ |

$611.4 1.2% |

8 |

|

ProShares UltraPro Short QQQ SQQQ |

$14.44 3.4% |

3 |

|

Victory Capital VCTR |

$67.37 1.4% |

6 |

|

SEI Investments SEIC |

$84.6 0.2% |

7 |

|

Hamilton Lane HLNE |

$119.8 2.3% |

6 |

News

TQQQ Alternative Data

Reddit Mentions

ProShares UltraPro QQQ has been mentioned an estimated 9 times in investment subreddits on Reddit over the last 24 hours.

-

Reddit Mentions

9

-

Daily Change

80%

-

1 Month Change

28.6%

-

3 Month Change

80%

Reddit Sentiment

The sentiment Score for ProShares UltraPro QQQ is 44 out of 100, which represents a bearish sentiment.

-

Reddit Sentiment

43.75

-

Daily Change

14.2%

-

1 Month Change

37.1%

-

3 Month Change

13.7%

News Mentions

ProShares UltraPro QQQ was mentioned 3 times in the news yesterday.

-

News Mentions

3

-

Daily Change

25%

-

1 Month Change

0%

-

3 Month Change

0%

-

YoY Change

0%

TQQQ Financials

TQQQ Key Metrics

-

Total Revenue

¤0

-

Net Income

¤0

-

Earnings per Share

¤0

-

Free cash flow

¤0

-

EBITDA

¤0

-

EBITDA Ratio

-

Total Assets

¤0

TQQQ 2-year Revenue & Income

TQQQ 2-year Free Cash Flow

TQQQ Technicals

TQQQ SMA

TQQQ RSI

FAQ

What's the current price of ProShares UltraPro QQQ (TQQQ) Stock?

The price of an ProShares UltraPro QQQ (TQQQ) share is $108.9.

What's the market cap of ProShares UltraPro QQQ?

The current market cap of ProShares UltraPro QQQ is 28.5B.

What are some stocks similar to ProShares UltraPro QQQ (TQQQ) that investors often compare it to?

ProShares UltraPro QQQ (TQQQ) is often compared to similar stocks such as Invesco QQQ, ProShares UltraPro Short QQQ, Victory Capital, SEI Investments and Hamilton Lane.

What is the forecast for ProShares UltraPro QQQ's stock price in 2026?

Using a mix of financial analysis, technical indicators, and alternative data, we forecast ProShares UltraPro QQQ's stock price to be around $121.8 in 2026. Starting from the current price of $108.9, this represents a 11.9% change in price, indicating a bullish outlook for the stock.

How to buy ProShares UltraPro QQQ (TQQQ) Stock?

ProShares UltraPro QQQ stock is available for purchase through numerous brokerage firms, including online platforms. Investors can also buy ProShares UltraPro QQQ shares via trading apps on their smartphones or by utilizing services like robo-advisors for automated investing.