Quanta Services (PWR) Stock Price

$443.5 5.2%

to add to portfolio

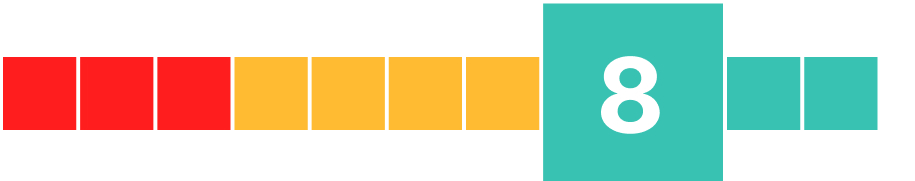

AI Score

-

Alternative

9 -

Fundamental

7 -

Technical

7

Our AI Score rates companies on a scale from 0 to 10, based on alternative data points such as web traffic, app downloads, and job postings — combined with financial health indicators and technical signals. Scores are designed to reflect relative strength or weakness across these factors, helping users compare companies and track changes over time.

Sign up to get access to more historical data and insights on Quanta Services, AI stock picks, stock alerts and much more.

PWR AI Stock Analysis

Financial Performance

Quanta Services' last quarter results show a positive trend, with revenue up by 16.1% from the previous quarter and 12.3% year over year to $6.5B. Gross profit also increased significantly, up by 23.2% QoQ and 25.8% YoY to $902.1M. Operating income profit was at $431.2M, a rise of 39.6% QoQ and 29.1% YoY, indicating improved operational efficiency and profitability.

The EBITDA ratio is at a healthy level of 0.1 while the PE ratio stands at high levels of around 58 which may point towards overvaluation.

Stock Price

The stock price is currently down by -7.1%, trading at around $313 per share, compared to its 200-day moving average of $284 which indicates that despite the recent drop the stock has been in an upward trend for some time now.

The RSI value is currently at around mid-range (54) suggesting neither overbought nor oversold conditions.

Alternative Data Signals

Quanta Services' web traffic shows a slight decrease (-3.% MoM), however job postings indicate growth (+5.% MoM). The company's social media following has seen substantial growth across all platforms (Twitter +8%, Instagram +36%, Facebook +30%) in the last three months which could suggest growing public interest or improved marketing efforts.

A significant majority (79%) of employees report having a positive business outlook for Quanta Services, pointing towards strong internal confidence about future performance.

Conclusion

Despite the recent drop in stock price, Quanta Services’ strong financial performance, increasing social media presence and positive internal sentiment indicate a bullish outlook for the stock. However, investors should be cautious of potential overvaluation as indicated by the high PE ratio.

Note: This AI Stock Analysis is based on data as of January 11. Our members can refresh and get access to an up-to-date AI stock analysis.

Sign up

Quanta Services (PWR) Price Prediction

Based on a combination of financial analysis, technical indicators, and insights from alternative data, we predict that the stock price of Quanta Services (PWR), currently trading at $443.5, will... Sign up to access price prediction.

About PWR

-

Quanta Services, Inc.

-

Symbol

PWR

-

Market

NYSE

-

Industry

Engineering & Construction

-

Market Cap

65.6B

Similar Stocks

|

Granite Construction GVA |

$107.1 1.1% |

7 |

|

AECOM ACM |

$132.6 2.5% |

6 |

|

Fluor FLR |

$44.04 2.6% |

6 |

|

Ameresco AMRC |

$38.59 0.7% |

6 |

|

Jacobs Solutions J |

$157.4 1.3% |

6 |

News

PWR Alternative Data

Web Traffic

Quanta Services receives an estimated 64811 monthly visitors to quantaservices.com.

-

Web Traffic

64811

-

Change from Previous Month

5.1%

-

3 Month Change

56.4%

-

YoY Change

56.4%

Twitter Followers

Quanta Services has 2,280 Twitter Followers on its main Twitter (also known as X) account, which is up by 0.1% over the last month.

-

Twitter Followers

2280

-

Daily Change

0%

-

1 Month Change

0.1%

-

3 Month Change

1.9%

-

YoY Change

1.9%

Facebook Engagement

Quanta Services has engaged 509 users via their Facebook Page over the last 7 days.

-

Facebook Engagement

509

-

Daily Change

5.2%

-

1 Month Change

54.6%

-

3 Month Change

79%

-

YoY Change

79%

Instagram Followers

Quanta Services has 12,240 Instagram Followers on its main Instagram account, up by 1.2% over the last month.

-

Instagram Followers

12240

-

Daily Change

0%

-

1 Month Change

1.2%

-

3 Month Change

4.5%

-

YoY Change

4.5%

LinkedIn Followers

100,108 are following Quanta Services on LinkedIn, up by 1.9% over the last month.

-

LinkedIn Followers

100108

-

Daily Change

0.1%

-

1 Month Change

1.9%

-

3 Month Change

6.2%

-

YoY Change

6.2%

Job Postings

Quanta Services currenly has an estimated 25 open job postings, up by 47.1% over the last month.

-

Job Postings

25

-

Daily Change

4.2%

-

1 Month Change

47.1%

-

3 Month Change

257.1%

-

YoY Change

257.1%

LinkedIn Employees

According to LinkedIn, Quanta Services has 5,766 employees, up by 0.5% over the last month.

-

LinkedIn Employees

5766

-

Daily Change

0%

-

1 Month Change

0.5%

-

3 Month Change

3.9%

-

YoY Change

3.9%

Reddit Mentions

Quanta Services has been mentioned an estimated 0 times in investment subreddits on Reddit over the last 24 hours.

-

Reddit Mentions

0

-

Daily Change

0%

-

1 Month Change

0%

-

3 Month Change

0%

Business Outlook

According to employee reviews, the business outlook among employees at Quanta Services is 91 out of 100 (very bullish).

-

Business Outlook

91

-

Change from Previous Month

0%

-

3 Month Change

0%

-

YoY Change

0%

News Mentions

Quanta Services was mentioned 2 times in the news yesterday.

-

News Mentions

2

-

Daily Change

0%

-

1 Month Change

0%

-

3 Month Change

0%

-

YoY Change

0%

PWR Financials

PWR Key Metrics

-

Total Revenue

$6.2B

-

Net Income

$144.3M

-

Earnings per Share

$0.97

-

Free cash flow

$0

-

EBITDA

$239.1M

-

EBITDA Ratio

0.0383552

-

Total Assets

$19.1B

PWR 2-year Revenue & Income

PWR 2-year Free Cash Flow

PWR Technicals

PWR SMA

PWR RSI

FAQ

What's the current price of Quanta Services (PWR) Stock?

The price of an Quanta Services (PWR) share is $443.5.

What's the market cap of Quanta Services?

The current market cap of Quanta Services is 65.6B.

What are some stocks similar to Quanta Services (PWR) that investors often compare it to?

Quanta Services (PWR) is often compared to similar stocks such as Granite Construction, AECOM, Fluor, Ameresco and Jacobs Solutions.

What is the forecast for Quanta Services' stock price in 2026?

Using a mix of financial analysis, technical indicators, and alternative data, we forecast Quanta Services' stock price to be around $489.7 in 2026. Starting from the current price of $443.5, this represents a 10.4% change in price, indicating a bullish outlook for the stock.

How to buy Quanta Services (PWR) Stock?

Quanta Services stock is available for purchase through numerous brokerage firms, including online platforms. Investors can also buy Quanta Services shares via trading apps on their smartphones or by utilizing services like robo-advisors for automated investing.